If you’re a business owner or an accountant in

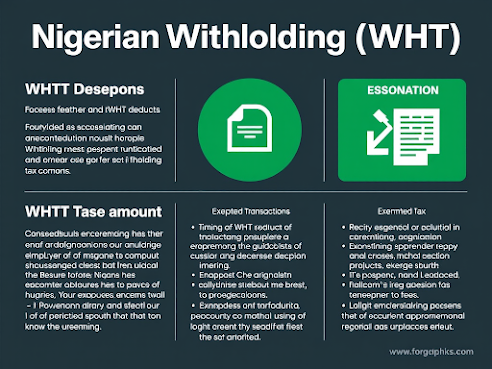

Nigeria, understanding Withholding Tax (WHT) is crucial for staying compliant

with tax regulations. One of the most common questions is: On what base

amount should the WHT rate be applied? Equally important is: When should

you deduct WHT? And last but not least: Are there exempted transactions

under the new WHT regulations?

Let’s go right on to provide answers with practical

examples to these germane questions.

Check this video on 10 Red Flags to Avoid Investment Scams

On What Base Amount

Should WHT Rate Be Applied?

You must deduct WHT from payments to suppliers, as

mentioned in my earlier post—New

Withholding Tax Regulations: Do All Businesses Need to Deduct?

However, one of the most common questions about WHT

is: On what base amount should the WHT rate be applied? This happens to

be one of the questions often bedevilling young and inexperienced accountants

and business owners in Nigeria.

The straightforward answer to this question is: WHT should

be applied only on the value of goods supplied or services rendered before VAT

is added. In other words, VAT is excluded from the WHT calculation. This means

you do not apply WHT to the total invoice amount—only to the base amount for

goods or services.

This brings up another question: How do you determine

the WHT Base Amount from an invoice or bill? What exactly constitutes the base

amount for goods and services?

Check this video on Nigerian WHT: Key Rules on Base Amount, Timing &Exemptions

For goods; should it include handling charges,

installation fees, delivery fees, trade discounts, or shipping fees? And for

services; should it include the cost of materials purchased to perform the

service, handling charges, delivery expenses, and other related costs?

The answer lies in what the Regulations say and what

constitutes out-of-pocket expenses.

According to Regulation 10(i) of the Deduction of Tax

at Source (Withholding) Regulations, 2024, the WHT base amount excludes

out-of-pocket expenses. The regulation states:

"Out-of-pocket expenses are those that are

normally expected to be incurred directly by the supplier and are

distinguishable from contract fees."

In practical terms: For goods, the WHT base amount is the

value of the goods alone, excluding trade discounts, handling charges, delivery

charges, installation charges, and labour charges, as these are considered

out-of-pocket expenses.

And for services, the WHT base amount is the

professional or service fee alone, excluding the cost of materials purchased to

perform the service and other related out-of-pocket expenses.

By applying these rules, you can correctly determine

the WHT deduction for your supplier payments.

WHT Base Amount: Examples

Make it Clearer

Let’s look at two examples to make this crystal clear.

Case Study 1: WHT on Goods Purchase

XYZ Enterprises Ltd purchases 100 office chairs from

ABC Furniture Ltd. The invoice details are as follows:

- Cost of Chairs: ₦1,500,000

- Delivery

Charges: ₦50,000

- Installation

Fees: ₦30,000

- VAT (7.5% on ₦1,580,000):

₦118,500

- Total Invoice

Amount: ₦1,698,500

The

question is: Given the WHT rate of 2%, on what base amount should it be applied

to get the WHT amount to deduct from payment to ABC Furniture Ltd?

As per WHT regulations, tax is deducted only on the cost of goods, excluding

VAT and out-of-pocket expenses like delivery and installation.

- WHT Base Amount:

₦1,500,000

(Cost of Chairs)

- WHT Rate: 2%

(assumed for goods)

- WHT Deduction: ₦1,500,000 × 5% = ₦75,000

Final

Payment to Supplier:

Total Invoice Amount (₦1,698,500) – WHT (₦75,000) = ₦1,623,500

XYZ

Enterprises Ltd should withhold ₦75,000 and remit

it to the tax authority. WHT is not applied to delivery charges, installation

fees, or VAT.

Read Also: Nigeria

vs UK Stock Market: The ten most popular stocks - and how the markets compare

Case Study 2: WHT on Services

DEF Ltd. hires a consulting firm, Smart Solutions, for

tax advisory services. The invoice details are:

- Professional

Fee: ₦800,000

- Cost of Tax

Research Materials: ₦50,000

- Printing & Delivery

of Reports: ₦20,000

- VAT (7.5% on ₦870,000): ₦65,250

- Total Invoice

Amount: ₦935,250

For services, WHT is applied only to the professional

fee, excluding the cost of materials, delivery charges, and VAT.

- WHT Base Amount:

₦800,000

(Professional Fee)

- WHT Rate: 10%

(assumed for services)

- WHT Deduction: ₦800,000 × 10% = ₦80,000

Final

Payment to Supplier:

Total Invoice Amount (₦935,250) – WHT (₦80,000) = ₦855,250

Take note: WHT is deducted only from the service fee

and not from materials, delivery costs, or VAT. The tax authority receives ₦80,000, while

the supplier receives ₦855,250.

These scenarios illustrate how to correctly determine

the WHT base amount and ensure compliance with tax regulations.

When should you

deduct WHT?

Timing is everything when it comes to WHT deductions.

Under the new regulations, you must deduct WHT at the earlier of two events:

1. When payment is made: If you’re paying a supplier

upfront, you must deduct WHT at the time of payment.

2. When the liability is recognized: If the amount due

is recorded as a payable (even if payment is delayed), WHT should be deducted

at that point.

For transactions between related parties, the rules

are slightly stricter. WHT must be deducted either when payment is made or when

the liability is recognized—whichever happens first.

For practical example on when to deduct WHT, let’s

revisit XYZ Enterprises Ltd and ABC Furniture Ltd. to understand the timing of

WHT deductions.

o Invoice Date: October 1, 2024

o Payment Date: October 15, 2024

In this case, XYZ Enterprises Ltd must deduct WHT on October

15, 2024, when the payment is made. However, if XYZ Enterprises Limited records

the liability in its books on October 10, 2024, WHT must be deducted on that

date, even if the payment is made later. That’s, at the point of posting the

transactions into the ledger, WHT must be recognised or posted accordingly.

Are there

exempted transactions under the new WHT regulations?

When it comes to Withholding Tax (WHT), not all

transactions are created equal. While many payments to suppliers and

contractors require you to deduct WHT, there are several exceptions to the

rule. These exemptions are designed to simplify the tax process, reduce the

burden on certain industries, and encourage specific types of economic

activities. If you’re a business owner in Nigeria, it’s crucial to understand

which transactions are exempt from WHT deductions to avoid overpaying or

underpaying taxes.

Read Also: Understanding

Time Value of Money vs Inflation

So, the next time you’re reviewing a payment or

invoice, take a moment to check if it falls under one of these exemptions below:

1. Payments for

Goods Manufactured or Materials Produced by the Supplier

If you’re purchasing goods or materials that are manufactured

or produced by the supplier, you don’t need to deduct WHT. This exemption is

particularly beneficial for manufacturers and producers, as it reduces the

administrative burden of tax compliance.

2. Imported Goods

(If the Foreign Supplier Doesn’t Have a Taxable Presence in Nigeria)

When you import goods into Nigeria, you might wonder

whether WHT applies. The good news is that if the foreign supplier doesn’t have

a taxable presence in Nigeria, the transaction is exempt from WHT. This means

that if the supplier isn’t registered or operating in Nigeria, you don’t need

to deduct WHT from the payment. However, if the foreign supplier has a taxable

presence in Nigeria (e.g., a branch or office), WHT may still apply. This

exemption helps facilitate international trade while ensuring that foreign

businesses without a Nigerian presence aren’t unfairly taxed.

3. Insurance

Premiums

Insurance is a critical part of risk management for

businesses, and the good news is that insurance premiums are exempt from WHT.

Whether you’re paying for property insurance, liability insurance, or any other

type of coverage, you don’t need to deduct WHT from these payments.

4. Bank Interest

and Fees Paid via Direct Debit

If you’re paying interest or fees to a Nigerian bank

through a direct debit arrangement, these payments are exempt from WHT. This

exemption applies to transactions where the funds are domiciled with the bank,

making it easier for businesses to manage their banking relationships without

worrying about WHT deductions. It also encourages the use of formal banking

channels, which is a key part of Nigeria’s financial inclusion strategy.

5. Telecommunication

Services (e.g., Internet, Phone Bills)

In today’s digital age, telecommunication services are

essential for businesses to operate efficiently. Fortunately, payments for telecommunication

services, such as internet data and phone bills, are exempt from WHT. This

means you don’t need to deduct WHT when paying your monthly internet or phone

bills.

Read Also: What

Businesses/Suppliers Need to Know About Withholding Tax in Nigeria

6. Winnings from

Entrepreneurial or Academic Reality Shows

Reality shows that promote entrepreneurship,

academics, technological innovation, or scientific advancement are becoming

increasingly popular in Nigeria. If you or your business receives winnings from

such shows, you’ll be glad to know that these winnings are exempt from WHT.

This exemption encourages participation in programs that drive innovation and

skill development, contributing to Nigeria’s economic growth.

7. Broker

Commissions

Brokers play a vital role in facilitating transactions

across various industries, from real estate to financial markets. Under the new

WHT regulations, **commissions retained by brokers** from money collected on

behalf of their principals are exempt from WHT. This exemption applies as long

as the commission is in line with industry norms. By exempting broker

commissions, the government aims to support the brokerage industry and ensure

that brokers can operate without unnecessary tax complications.

8. Registered

Securities Lending Transactions

Securities lending is a common practice in the

financial sector, where securities are temporarily transferred from one party

to another. Payments made under Registered Securities Lending Transactions are

exempt from WHT. This exemption helps maintain liquidity in the financial

markets and supports the smooth functioning of securities lending activities.

9. Dividend

Payments to Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are a popular

investment vehicle for those looking to invest in real estate without directly

owning property. Under the new regulations, dividend payments to REITs are

exempt from WHT. This exemption encourages investment in the real estate sector

and supports the growth of REITs in Nigeria.

10. Any Income or

Profit That Is Exempt from Tax Under Nigerian Law

If a payment relates to income or profit that is

already exempt from tax under Nigerian law, it is also exempt from WHT. This

ensures that businesses and individuals don’t face double taxation on income

that is already tax-free. For example, certain agricultural income or income

from export activities may be exempt from tax, and consequently, WHT deductions

don’t apply.

11. Petroleum

Products Such as PMS, AGO, and LPG

The energy sector is a cornerstone of Nigeria’s

economy, and the government has provided specific exemptions for certain

petroleum products. Payments for Premium Motor Spirits (PMS), Automotive Gas

Oil (AGO), Liquefied Petroleum Gas (LPG), and other related products are exempt

from WHT. This exemption helps stabilize the energy market and ensures that

businesses and consumers can access these essential products without additional

tax costs.

Final Thoughts:

Summary and Conclusion

The three key areas—WHT Base Amount, When to Deduct

WHT, and Exempted Transactions—are critical for ensuring compliance and

avoiding penalties. Let’s recap the key takeaways:

1. WHT Base Amount:

- WHT is

applied only on the value of goods or services before VAT is added.

-

Out-of-pocket expenses, such as delivery charges, installation fees, and

material costs, are excluded from the WHT base amount.

- For goods,

the base amount is the cost of the goods alone. For services, it’s the

professional or service fee, excluding related expenses.

2. When to Deduct WHT:

- WHT must be

deducted at the earlier of two events: when payment is made or when the

liability is recognized.

- For

related-party transactions, WHT must be deducted at the time of payment or

liability recognition, whichever comes first.

3. Exempted Transactions:

- Certain

transactions, such as payments for manufactured goods, imported goods (without

a taxable presence), insurance premiums, telecommunication services, and broker

commissions, are exempt from WHT.

-

Understanding these exemptions can save your business from unnecessary tax

deductions and streamline your financial processes.

Understanding Withholding Tax (WHT) in Nigeria is not

just about compliance—it’s about empowering your business to operate

efficiently and avoid unnecessary costs. By mastering the rules around WHT base

amounts, timing of deductions, and exempted transactions, you can ensure that

your business remains compliant while focusing on growth and

profitability.

So, the next time you receive an invoice or prepare to

make a payment, take a moment to apply these rules. It’s a small step that can

save you from big headaches down the line.

Kindly let me know your thoughts on this in the

comment section below. Thank you.

%20-%20visual%20selection%20(1).png)

%20-%20visual%20selection.png)

0 Comments